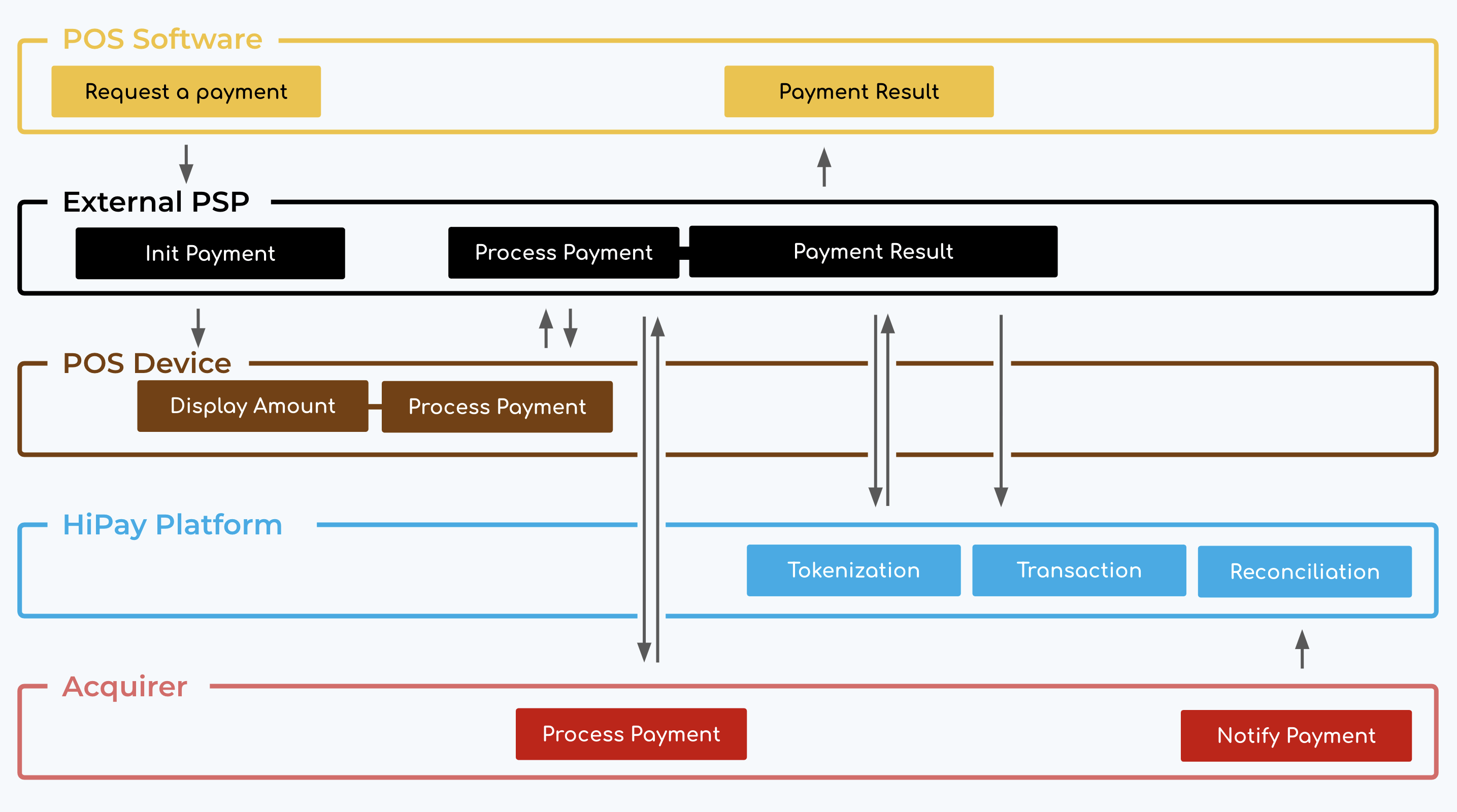

This integration allows you to leverage Hipay’s platform to manage the transaction lifecycle and its data while using another PSP to perform the POS payment.

If you want to have a better understanding of the Order API, please read the following documentation.

Payment

Here is the 5-step process to pay using a POS terminal in passive mode:-

-

- To display the transaction on your POS terminal your ECR system will request a payment to your non-HiPay PSP.

- This PSP, will display the amount to pay in your POS terminal.

- Once the card is inserted, the PSP will get the customer’s card details.

- Using these card details, the PSP will be able to authorize the customer using an external AAS Acquirer.

- The authorization response will be sent to your ECR.

-

Transaction Log

Once the payment has been confirmed, your system will request HiPay to create a passive transaction. This process is divided in two steps:Tokenization

A secure token can be generated from the customer’s card details using HiPay’s Tokenization API. Please, follow the tokenization API documentation in order to integrate this feature. This first step is optional and can be implemented if you have the card information.Order

You can use the Order API in order to create the transaction after you have created an HiPay’s token or you can create an order without the token (in the last case, the token will be added during the reconciliation). In order to do so, you need to integrate the Order API in the following way: Endpoint URL Stage https://stage-secure-gateway.hipay-tpp.com/rest/v1/order Production https://secure-gateway.hipay-tpp.com/rest/v1/order Authentication Basic Auth of your Hips private account credentials (username, pwd) Order API call| Parameter | Type | Presence | Description | Example |

orderid |

STRING | Mandatory | Unique order ID | ORDER_234 |

eci |

INTEGER | Mandatory | The Electronic Commerce Indicator (ECI) indicates the security level at which the payment information is processed between the cardholder and merchant. Value is : 10 = proxi | 10 |

description |

STRING | Mandatory | Short description of the order. | Transaction |

currency |

STRING | Mandatory | ISO 4217 three-character currency code. | EUR |

amount |

INTEGER | Mandatory | Total order amount, calculated as the sum of purchased items, plus shipping fees, plus tax fees. | 8.99 |

payment_product |

STRING | Mandatory | The payment method used to proceed checkout. Value is: tpe = without card token | tpe |

initialize_payment_terminal |

BOOLEAN | Mandatory | Whether a transaction is in passive mode. Value is : 0 = Passive mode | 0 |

payment_product_parameters |

JSON | Mandatory | hash: hash algorithm based on sha1(orderid + amount + currency + hashkey) | db75353234324dfdfdsd5635d |

| Mandatory | code: transaction status. Values are: 200000 = Authorized 200100 = Captured 200350 = Credit | 200100 | ||

| Mandatory | mid: merchant contract | 6 | ||

| Mandatory | acquirer_registrationid: merchant contract | 6 | ||

| Conditional | acquirer_reference: bank field 37, that represents a unique id for the authorized transactions. Data used for the reconciliation. Max length value = 11 digits. | 12345678901 | ||

| Conditional | authorization_code: if an authorization code is delivered by issuer for this transaction | 100969 | ||

| Optional | cardToken: token of the tokenization API. | ef3b4d50325268e59d216c0b053a4f5c7eb559f9abeca0ef178ea1941b2d156a | ||

operation |

STRING | Optional | Transaction type: Sale indicates that the transaction is automatically submitted for capture. Authorization indicates that this transaction is sent for authorization only. Credit indicates that this is a credit transaction. Default value : Authorization | authorization |

custom_data |

JSON | Optional | custom data to be linked with the transaction | {“internal_reference”:”ORD_987465″,”customer_first_order”:true,”other_sample_parameter”:”Other sample value”} |

firstname |

STRING | Optional | Cardholder’s name | John |

lastname |

STRING | Optional | Cardholder’s lastname | Doe |

email |

STRING | Optional | Cardholder’s email | [email protected] |

cid |

STRING | Optional | Customer ID | 12345 |

basket |

JSON | Optional | Shopping cart details. More information This cart content must be compliant with the transaction fields (total amount must be equal to the products in the basket, …) | [{“european_article_numbering”:”4711892728946″,”product_reference”:”NF-a1690″,”name”:”My first product”,”type”:”good”,”quantity”:1,”unit_price”:8.99,”discount”:0,”tax_rate”:”8.20″,”total_amount”:8.99}] |

Capture & Cancel

At the end of the day, once the daily collection is done, you can update the status of the transactions created at HiPay to “Captured” or “Cancelled”. In order to do this, you need to integrate the Maintenance API. Please read the following documentation in order to integrate it.Acquirer reconciliation journal

The Acquirer reconciliation journal refers to the acquirer’s reconciliation file or API. This document contains the transactions that have been authorized by a given acquirer, and that have been successfully settled. This journal is essential to reflect, as until this moment HiPay doesn’t know for sure the transactions that have been successfully settled. Once HiPay receives this information, it updates the transaction status.Refund a Transaction

To make a total or partial refund of a transaction, you can use either our API or the HiPay Enterprise back office. Here you have the documentation to refund a transaction using the API. Please note:-

-

- refunds can’t be made if an operation chargeback was already asked from the customer for this transaction.

- refunds must be made within 11 months after capture for card transactions. Conditions may differ depending on payment methods.

-